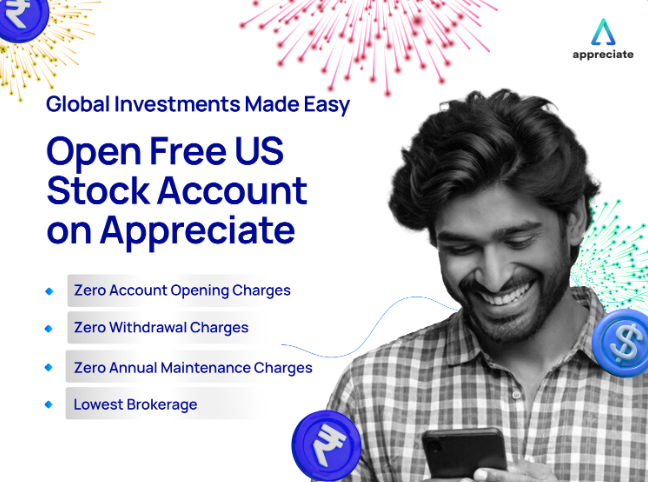

Benefits of appreciate wealth demat account and how to apply ?

An Appreciate Wealth Demat Account offers various benefits for individuals looking to invest in the stock market and manage their securities digitally. Here are some key advantages:

1. Digital Convenience

- A demat account enables electronic storage of shares and securities, eliminating the need for physical share certificates. This reduces the risks of loss, theft, or damage.

2. Seamless Transactions

- With a demat account, you can easily buy and sell shares through an online platform. The settlement process is faster, and shares are credited or debited from the account within two business days.

3. Cost-Efficiency

- It reduces the cost of handling physical certificates, such as stamp duties, handling charges, and courier fees. Additionally, lower transaction fees may be charged in comparison to traditional methods.

4. Access to a Wide Range of Investments

- Apart from equities, an Appreciate Wealth Demat Account allows you to hold various securities, including bonds, mutual funds, ETFs, and government securities, providing a diversified investment portfolio.

5. Security and Transparency

- Since the demat account operates under the regulatory framework of SEBI, it offers secure handling of investments. Account holders can easily track their holdings, transactions, and investment performance with transparency.

6. Loan Against Securities

- Investors can pledge securities held in their demat account as collateral to obtain loans from banks or financial institutions, providing liquidity without the need to sell off assets.

7. Nomination Facility

- The account allows you to appoint a nominee, ensuring that your assets are easily transferred to the designated person in the event of your demise, offering a secure succession plan.

8. No Minimum Balance Requirement

- Unlike some bank accounts, demat accounts generally do not require you to maintain a minimum balance, which makes it a flexible option for all kinds of investors.

These features make an Appreciate Wealth Demat Account a reliable and efficient tool for managing investments digitally.

In 1996, the Indian stock market underwent a significant technological change with the introduction of dematerialised (demat) accounts for transactions on the National Stock Exchange (NSE).

Also Read: How to Open Axis Current Account and it’s Benefits |

A demat account is an electronic account used to store investments like stocks, ETFs, mutual funds, and commodities. Instead of holding physical certificates, these investments are “dematerialised” and stored in the demat account. This process is managed by a depository participant (DP), such as a bank, broker, or financial institution.

Why is a demat account important?

According to SEBI’s rules, a demat account is mandatory to invest in stocks. Without one, it’s impossible to buy shares, as there would be no place to hold them. Although not required for other securities like bonds or mutual funds, using a demat account offers advantages. It simplifies tracking all investments in one place, enables online trading from anywhere, and provides better security against loss or damage of physical certificates. It also speeds up transactions and eliminates costs like stamp duties or handling charges. Another benefit is that you can designate a nominee, ensuring your investments are easily transferred in the event of your death.

Eligibility criteria for opening a demat account

To open a demat account, you’ll need to do so through a DP, which could be a bank or financial institution. Ideally, it’s best to open both a demat and trading account with the broker or investment platform where you plan to manage your investments. DPs generally charge account opening and annual maintenance fees, but some platforms, like Appreciate, may not have such annual fees.

The eligibility criteria are fairly standard across DPs:

- Age: You don’t have to be 18 to open a demat account. Minors can have one, but it must be operated by a parent or legal guardian until they reach adulthood.

- Citizenship: Indian residents and NRIs (Non-Resident Indians) can open a demat account.

- Documents: You’ll need to provide identity proof, address proof, and income proof. Some commonly accepted documents include:

- PAN card, Aadhaar card, passport, voter ID, or driver’s license for identity verification.

- Aadhaar card, utility bills, bank statements, or government-issued documents for address proof.

- Salary slips, bank statements, ITR returns, or a net-worth certificate for income proof.

Documents and the process for opening a demat account

To open a demat account, the following steps and documents are needed:

- Identity proof: PAN card, Aadhaar card, passport, voter ID, etc.

- Address proof: Aadhaar card, passport, utility bill, or a bank statement.

- Income proof: Salary slips, bank statements, or ITR.

- Bank details: A cancelled cheque, passbook, or bank statement to link your bank account to your demat account.

Verification and submission process

Once you’ve gathered all the necessary documents:

- Attest your documents: Some brokers may require attestation from a public sector bank manager, notary, magistrate, or embassy official. In other cases, self-attestation is sufficient.

- Submit your documents: You can do this either online or in person at a branch. The online method is quicker and more convenient.

- Sign the agreement: After KYC verification, you will need to sign an agreement with the DP, outlining both parties’ rights and responsibilities.

Once the process is completed, you’ll receive your account details, including your Beneficiary Owner Identity (BOID) or Unique Client Code (UCC), which will be used for future transactions.

Start investing easily

With Appreciate, you can open a demat account online in just a few steps. The platform also offers tools to help build a diversified investment portfolio. Additionally, it allows you to invest in international markets, including U.S. stocks and ETFs, providing global diversification.

Frequently asked questions (FAQs)

- Is Indian citizenship required to open a demat account?

Yes, both resident Indians and NRIs are eligible to open a demat account. - Can a minor open a demat account?

Yes, but a parent or guardian must operate it until the minor turns 18. - Do you need specific educational qualifications?

No, there are no educational qualifications required to open a demat account. - Can NRIs open a demat account?

Yes, NRIs can open an NRE or NRO demat account to invest in India. - Is a minimum income required to open a demat account?

No, although income proof is sometimes required, a minimum income level isn’t mandatory unless you plan to trade in futures and options. - What is the difference between a demat and trading account?

A demat account stores your investments in electronic form, while a trading account is used to place buy and sell orders.

Next Story:

7 thoughts on “Benefits of appreciate wealth demat account and how to apply ?”